Best Final Expense Whole Life Insurance

Reviewed by

Nick Fenske

Licensed Insurance Agent

Written by

Brian Greenberg

CEO / Founder & Licensed Insurance Agent

Last updated: April 24th, 2023

Reviewed by

Nick Fenske

Licensed Insurance Agent

Table of Contents

| Company | Recommendation | StarRating | Quote |

|---|---|---|---|

| Recommended Policies with and without health questions. Coverage up to 30k. Best-priced policies. Apply with an agent. Policies with and without a waiting period. | ★★★★★ Mutual of Omaha Life Review | Go | |

Recommended | ★★★★★ Gerber Life Review | Go | |

Policies with and without health questions. | ★★★☆☆ TruStage Review | Go |

Final expense life insurance comes in six different types. Each type has its own structure and pricing. Generally, the healthier the applicant is, the more benefits the policy will include, and the more affordable the policy will be.

We’ll talk about each type of final expense in depth below:

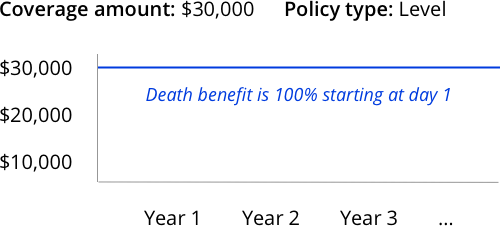

A level policy is the most basic and straightforward of the final expense policies. Level policies are issued to applicants who are in good health, with any health issues having been controlled for at least three years. The full amount of the policy will be in effect the day the application is approved. When the insured person dies, the named beneficiaries can receive the full death benefit right away.

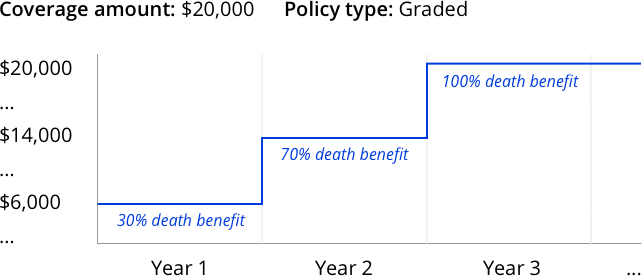

Depending on the insurance company chosen, applicants can often qualify for a graded policy if they have not had any major illnesses in the past 24 months.

For example, a graded plan might be right for someone with Parkinson’s disease or some other medically manageable disease. If a non-accidental death occurs within a two-year time frame, the policy will only pay a percentage of the total death benefit. During the third year and beyond, the entire death benefit will be paid.

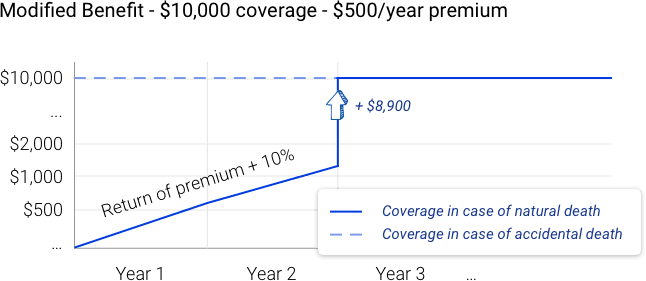

A modified policy is very similar to a graded policy except it involves a serious illness, such as cancer, instead of a more manageable ailment. Modified policy benefits usually have a two-year waiting period before the entire death benefit can be paid to a beneficiary.

If a non-accidental death occurs before that two-year time frame, the policy will only pay a return of the paid premiums plus a small percentage of the total death benefit. During the third year and beyond, however, the entire death benefit will be paid.

A guaranteed issue policy is a policy with no health questions. There’s a two-year waiting period before the entire death benefit can be paid to a beneficiary.

In years 1 and 2, the benefit is the return of all the money paid thus far plus 10%. This protects insurance companies in cases where the person who purchases the policy already has a terminal diagnosis or is in hospice. For accidental death, the full benefit amount is paid to beneficiaries in years 1 and 2.

In year 3, the full benefit amount is paid to beneficiaries.

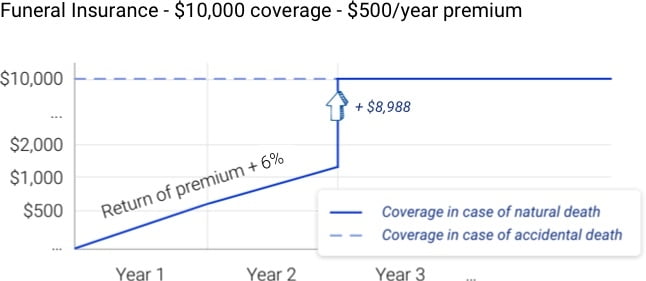

A pre-need funeral policy is purchased directly from a funeral home, and the funeral home is named as the beneficiary. The purpose is to pay for one’s funeral in advance. The policy covers the cost of funeral home services, a casket, burial fees, and memorial services.

The negatives: This is more like a layaway plan than a life insurance policy. These plans are offered as single-pay, 1-year, 5-year, and 10-year payment options. Once a plan is chosen, it’s locked in and difficult (or impossible) to change.

The positives: The positives: Once the plan is in place, there is no hassle or worry about needing to plan for a funeral at the last minute. And, the prices are set ahead of time.

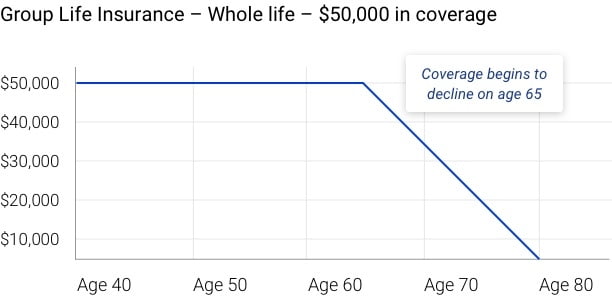

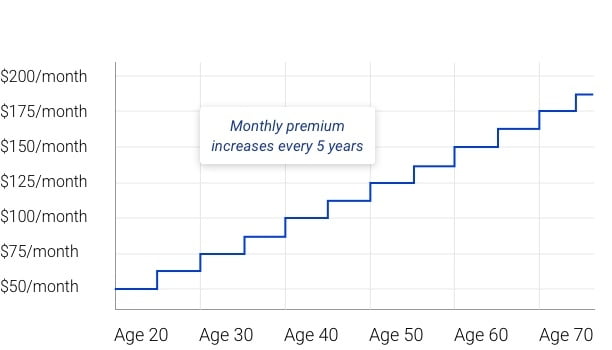

Group life insurance is a type of policy that is provided by an employer, an association, or an organization. Each group has its own requirements for becoming a member.

Each group or association has different products. The products are issued by an insurance company, but the group is the master policyholder. This means that instead of the insurance company issuing each person an individual policy, everyone named on the policy receives a certificate of insurance.

Service for the policy is provided by the plan administrator rather than the insurance company directly.

Group life insurance is available to all ages, and there are very few health questions, if any, to qualify. Coverage amounts start at $10,000. Term and whole life policies may be available, depending on the group.

Final expense insurance is intended to help cover expenses incurred during the end of life, including medical bills.

Unless there is a life insurance policy, it can take a long time to transfer assets after death. In that situation, the family is often saddled with burial costs and other expenses until the assets become available.

Consider the following four criteria when choosing a final expense insurance policy:

Every insurance company has slightly different qualifying questions on its application. Where it gets tricky is finding the lowest cost policy while taking into account the different qualifications to get approved.

For example, someone who had cancer and was last treated more than two years ago could qualify for a level policy from Royal Neighbors that provides immediate full coverage. But if the same person applied to Mutual of Omaha, he or she would only qualify for a graded policy, which would have a two-year waiting period before the full benefits of the policy would be paid.

We talk to people all the time who want coverage right away with no health questions. Often, these people qualify for better policies if they are willing to answer some health questions.

If you can answer “no” to all of the following questions, then you can qualify for a policy that is priced better than a guaranteed acceptance policy with no health questions.

Questions on the application must be answered truthfully.

Insurance companies verify the information on an application by pulling public reports:

Choosing the right company can save 20 – 30% in premium costs for the same exact benefits.

A burial policy from Colonial Penn with no questions is over 20% more expensive than a no health questions policy from AIG (American Insurance Group).

Both companies are A rated. AIG offers up $25,000 in coverage, close to double the amount available from Colonial Penn. Both are modified policies with two-year waiting periods for full benefits. Both offer accelerated death benefit provisions. And both build cash value.

The biggest difference between policies from Colonial Penn and AIG is the cost.

| Final expense company comparison chart | |||

| Company & Product | Eligible Ages & Coverage amounts | True Blue Comments | |

|---|---|---|---|

Final Expense Whole Life Brochure |

45 – 89 years $3,000 – $35,000 |

Application is taken over the phone in just 15 minutes. One of the most lenient health questionnaires. Great pricing. Excellent customer service. | |

Living Promise Brochure |

45 – 85 years $2,000 – $40,000 |

Application is taken over the phone in 15 minutes. There may be a phone interview conducted by a company representative. One of the most popular final expense companies. Outstanding customer support. | |

|

30 – 80 years $10,000 – $100,000 |

The application takes 15 minutes to complete, and then another 15-minute call with a Royal Neighbors representative. The product comes with several membership benefits. One of the most lenient companies for those with health conditions. | |

|

0 – 75 years $1,000 – $35,000 |

One of the best-priced final expense plans. Application is taken over the phone in 20 minutes, and an instant approval is given. This is one of the best plans for those who qualify, due to the incredible pricing. | |

|

50 – 80 years $1,500 – $35,000 |

Application is taken over the phone in about 15 minutes. The pricing is fantastic on these products. Payments can be made by credit card. | |

|

20 – 80 years $5,000 – $50,000 |

This is one of the most lenient companies in terms of approving applications. There are several level benefit plans to choose from. This is a great product for those who have problems qualifying for first-day coverage. | |

|

50 – 85 years $2,000 – $30,000 |

Americo has lenient underwriting, so we recommend this product for people who meet the health requirements for first-day coverage.. Strong company with good customer support. | |

|

40 – 80 years $3,000 – $30,000 |

Application can be taken over the phone in 30 minutes and, with a voice signature, the policy is active immediately. Depending on your health situation, this may be the best-priced plan. | |

|

30 – 80 years $10,000 – $80,000 |

This is an interesting product in that there are living benefits riders included at no charge. These allow access to the death benefit in the event of serious illness or disability. | |

|

50 – 85 years $5,000 – $25,000 |

The application is completed online with a digital signature, and the process takes about 15 minutes. This policy has no health questions and is often the best-priced modified benefit plan. | |

|

50 – 80 years $5,000 – $25,000 |

Application takes 15 minutes to complete. There’s a 7% discount for paying monthly with ACH bank transfer. Excellent pricing that is often less expensive than modified plans with health questions. | |

|

0 – 89 years $5,000 – $40,000 |

Great product that offers the highest amount in guaranteed acceptance coverage ($40,000). If you are able to appropriately answer three medical questions, you can get $48,000 in coverage with first-day coverage. | |

|

25 – 80 years $2,500 – $25,000 |

Columbian has the only policy that provides guaranteed acceptance plans to people as young as 25. Coverage for most no-questions policies begins at age 50. | |

Preneed Insurance |

50 – 80 years $5,000 – $25,000 |

One of the leaders in pre-need insurance policies. Funeral homes often sell this product directly to customers. Security National is a good company with good customer service. | |

|

0 – 89 years $1,000 – $20,000 |

Application is taken on paper and takes 20 minutes to complete. Strong company financially. Policies are expensive. | |

Preneed Funeral Planning Brochure |

0 – 80 years $1,000 – $20,000 |

United Heritage is sold by agents and funeral homes. Costs are on the expensive side. Strong company financially. | |

Final Event Planning |

0 – 85 years $5,000 – $75,000 |

One of the more popular plans offered through funeral homes. Service is handled by the parent company, Assurant. Customers often report to us that the lack of customer service is frustrating. | |

Brian is the founder and CEO of Insurist and carries Life, Health, and Property & Casualty licenses in all 50 U.S. states. Since 2013, Brian has been a member of Million Dollar Round Table, a designation for the top 1% of financial advisors worldwide. Brian has been featured in Yahoo! Finance, Money.com, Entrepreneur.com, Life Happens, Forbes, MSN, and Good Financial Cents. Brian’s goal is to show customers the best products, the quickest answers to their questions, and provide expert advice.

Nick has worked in the insurance industry selling life insurance, endowment and retirement and annuity products. He has also worked as an consultant to Independent Financial Advisors, educating them about products and helping them meet the needs of their clients.