Life Insurance for Cancer Patients & Survivors

Reviewed by

Grant Desselle

Licensed Insurance Agent

Reviewed by

Grant Desselle

Licensed Insurance Agent

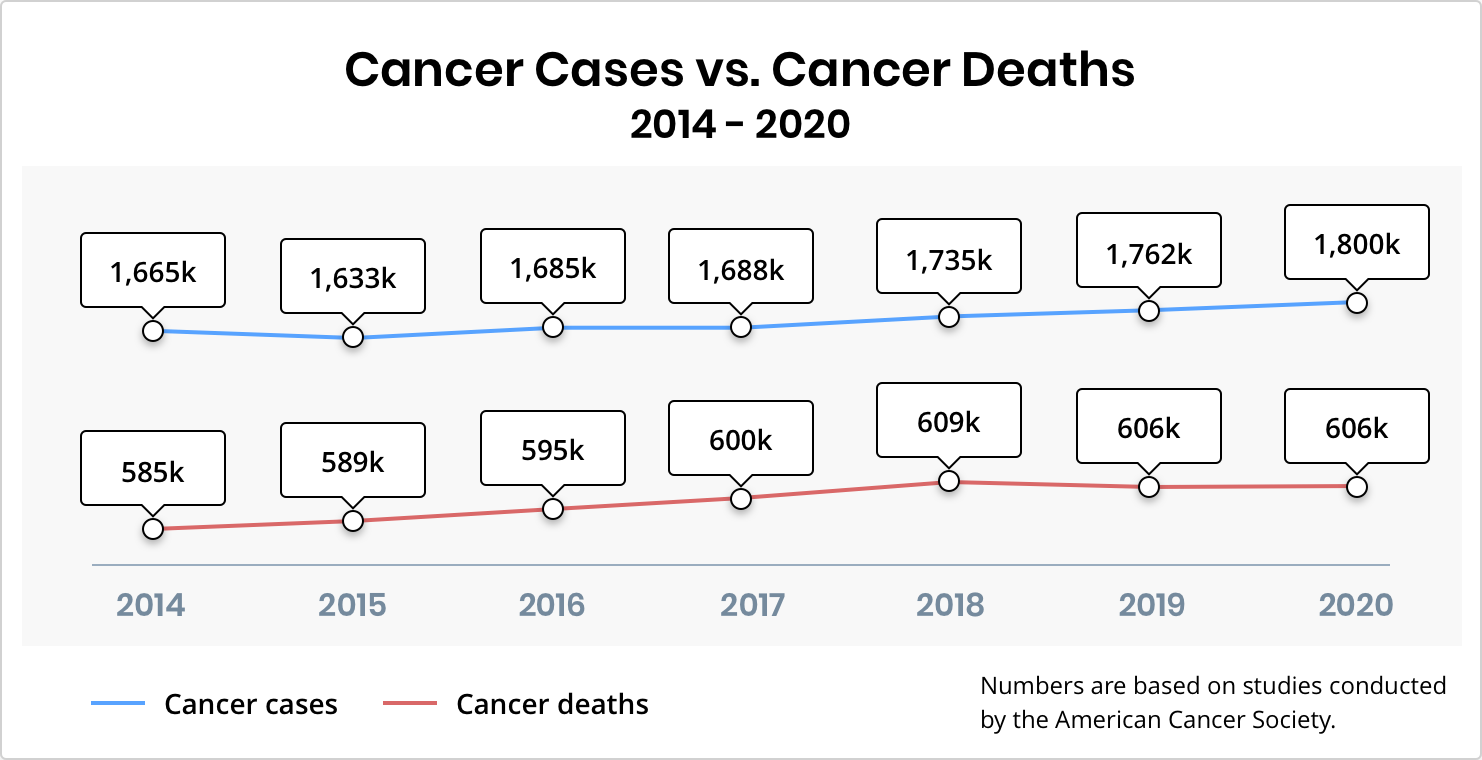

Cancer is a devastating disease, both physically and mentally. While many know someone who has or has had cancer, we like to believe it will never happen to us. Studies conducted by the American Cancer Society show that the number of new cancer cases has increased for decades.

But, there’s also good news. While new cases have been increasing, death due to cancer has been declining. This is especially true for certain types of cancer, like breast cancer. The survival rate for invasive breast cancer is 91%, and if the cancer is only located in the breast, it is 99% as of 2020.

Graph of new cancer cases vs cancer deaths for 2014 – 2020

Table of Contents

The short answer is, yes you can. What type depends on what stage of cancer you are in, active or remission, and if remission, how long.

| Stage | Life Insurance Options |

|---|---|

| You currently have cancer | Guaranteed Issue |

| You are in remission (within waiting period) | Guaranteed Issue |

| You are cancer-free (past waiting period) | Whole life or term life insurance (dependent upon the type of cancer in some cases) |

If you are diagnosed with cancer, or you are receiving treatment, you will only be eligible for a guaranteed issue policy. Guaranteed issue policies are an option for most people, regardless of their health. But, they are the most expensive type of life insurance.

The policy also may have a graded period. This means that the insurer will only pay the full benefit (coverage amount) if you outlive a specific term, usually 2 years. If you die during this term, your beneficiaries will not receive your coverage amount. Instead, they will receive any paid premiums + 10% (depending on the policy and insurer).

Guaranteed issue policies aren’t as flexible as term life insurance policies. The most common purpose for this type of policy is to cover funeral expenses. As a result, you can get between $2,500 and $40,000 of coverage. On the other hand, there is no medical exam required, and approval is guaranteed. That is as long as you meet the age requirements for the company you are applying with. This age requirement is typically 50-85, while some companies go as low as 45.

Even if you have recently finished treatment, the only life insurance option available to you is a guaranteed issue policy. How long you need to be in remission to qualify for other products depends on the type and stage of cancer. For example, breast cancer may only require 1 to 5 years, depending on the stage. Meanwhile, bone cancer requires a remission length of at least 5 years. See a list of types of cancers and typical waiting periods here.

Most doctors and insurers will label you as “cancer-free” after 5 years of remission for most types of cancer. At this stage, you will have more and better life insurance options available to you. Such as term life insurance, which offers the lowest rates for a pre-specified term like 20 years.

But again, this depends on the type and stage of cancer. It is for this reason we recommend that you contact us before you apply for life insurance. We work with the best life insurance providers. Each has its guidelines, and some are more lenient than others. We can help you find the best company and policy, based on your personal situation

Our service is at no cost and no obligation. If you do not like the life insurance solution our agents provide, you are not obligated to apply for it.

If you have the option to take out a life insurance policy with your employer while you are still working, you should take advantage of this. However, if you leave your job, you lose the policy. So it’s always best to purchase an individual policy on your own. We can help with that.

The insurer will want a lot of information, though, and full disclosure is key, says Scholz. “Disclosing cancer but glossing over other ailments wastes everyone’s time. Large amounts of coverage are going to be expensive. However, a well-informed agent with the right experience will help. A True Blue agent can provide you with the lowest cost options because they know what company to apply with.”

Unlike other brokers, we are not married to one insurance provider. Instead, we work with dozens of top-rated providers, and some of them are more lenient to individuals with a history of cancer.

Here’s what you’ll likely be asked:

| Type of Cancer | Likely Waiting Period | Other Factors |

| Breast | 1 to 5 years | Dependent upon stage |

| Lung | 3 to 5 years | With Stage 1 consideration can be three years from the end of treatment; Stage 2 is typically 5 years |

| Colorectal | 1 to 6 years | Stage 1, 2, and 3 have different waits |

| Uterine | 2 to 5 years | Stage 0 or 1 may qualify after 2 years, but rates will be high. After 4 to 5 years rates may be better. Beyond Stage 2, applicants will likely be denied |

| Hodgkins and Non-Hodgkins Lymphoma | 3 to 10 years | Time period is for Stages 1 & 2 only; others will likely be denied |

| Prostate | 6 months to 2 years | Stages 1&2, A, B can be as short as 6 months; Stage 3, C is likely 2 years |

| Bladder | 1 to 3 years or greater | 1 to 2 for Stage A; 3 or greater for Stage B |

| Melanoma | 1 to 5 years | 1 year for early detection; 2 to 5 years for deeper lesions; not at all for metastatic cancer |

| Testicular | 6 months to 2 years | 6 months for cancer that has not spread; 2 years for most others |

| Leukemia | 5 to 10 years | Dependent upon type; some are not insurable |

| Kidney | 1 to 5 years | T0 & T1 wait is 1 to 2 years; T2 & T3 can be up to 5 years |

| Pancreatic | 2 years | The waiting period only applies when cancer is detected in early stages; others will be declined |

| Cervical | 0 to 1 year | For Stage 1 or in-situ cancer |

| Esophageal | 3 years | Dependent upon stage |

| Larynx | 1 year | Dependent upon stage |

| Ovarian | 1 to 5 years or more | Dependent upon the stage and whether or not cancer has metastasized |

| Bone | 5 years or more | Dependent upon type; some are not insurable |

| Basal Cell Carcinoma | 0 to 3 months | This type may have no waiting period if cancer has not spread |

The short answer is yes. Both term and whole life policies will pay the death benefit if the cause of death is cancer-related.

The only reasons an insurer will not pay the death benefit if cancer is the cause of death is:

While this is a simple question, there’s no simple answer. It boils down to your personal situation, as well as your age and the type of cancer.

Here are a few examples of getting life insurance as a cancer patient or cancer survivor:

Current cancer patient, or in the first years of remission:

The only life insurance option available to you is guaranteed issue life insurance. This type of life insurance is quite expensive. It provides up to $40,000 in life insurance and typically has a graded death benefit of 2 years. During this time, your beneficiaries will not receive the full death benefit. Instead, they will receive any paid premiums + 10%, depending on the insurance provider.

If your life expectancy is less than 2 years:

Chances are slim your beneficiaries would even receive your death benefit. If your life expectancy is 2-5 years, a guaranteed issue policy does make sense since the graded period will be over, and your beneficiaries will receive the full death benefit.

When you are past the remission time for your type of cancer:

It may be best to wait until you are completely cancer-free to buy a term or whole life policy, as these policies offer better benefits at a much lower cost. Depending on your age, term life insurance is most popular for individuals under age 55. For those over 55, a final expense policy can provide up to $50,000 of coverage, without having to worry about a lapsing term.

At True Blue, we’re all about helping you find the right policy. When it comes to life insurance, there isn’t a “one product suits all” policy. We work with dozens of top-rated insurance providers to help you find the ideal one.

And if life insurance doesn’t make sense in your situation, we’ll tell you.

To get assistance with life insurance specifically for cancer patients and survivors, please fill out the form below: